Consistent predictions from consulting houses foresee doubling payments revenue to the tunes of trillions. However, is this feasible in the US market, which is still riding the consumer revenue wave?

While automation and digitalization of the B2B sector have opened new opportunities for financial services providers, banks in the US are still raking in card interchange revenue. In contrast, the rest of the world, particularly the Asia-Pacific region, is spearheading commercial revenue growth through emerging instant payment schemes.

In markets where the instant payments revolution has unfolded, substantial investments have been made in advanced market infrastructure. The United States also takes pride in its offerings like RTP and FedNow. The crucial question remains: Are banks keeping pace with the innovations crafted for their utilization?

Let’s take the example of India. The Unified Payments Interface(UPI) is a real-time payment system growing at a whopping 80% year on year and is expected to process more than a billion payments a day. At this rate, it is anticipated to snag 90% of payments in the country by 2026-2027. And this isn't just P2P payments – there is a substantial volume of payments in P2M transactions, thanks to merchants now getting a slice of the instant payment action directly into their bank accounts. B2B transactions are also picking up, mainly through overlay services designed by fintechs that address the bespoke needs of meeting the speed and efficiency of B2B payments.

Consumer instant payment use cases: low hanging but to no avail with revenue for banks

Central bank sponsored instant payment schemes aim to boost financial inclusion for the underbanked and unbanked through a speedy, efficient, and accessible payment infrastructure. Despite fostering innovative consumer uses, these initiatives typically offer minimal revenue prospects for banks. In India, the UPI is currently fee-free for consumers, and the anticipated FedNow in the US is expected to align with this model.

Which use cases dominate the instant payments in the US?

US banks embracing instant payments are experiencing a surge in B2C transactions, including payouts through social media, gambling, betting, and gaming apps. The gig economy daily wages and consumer refunds are also contributing to this trend. While consumers enjoy these services for free, it's crucial to acknowledge that the business entity initiating the payment bears the transaction cost, often paying to Payment Initiation Service Providers (PISPs) like Trustly, which charge a monthly service fee and a transaction fee for instant payments. This marks the initiation of open banking in action, offering banks the choice to either capitalize by enhancing value or remain passive spectators merely receiving instant payments.

B2B instant payments: Value drives revenue

It's intriguing to see that even in places where instant payments are commonplace, like India, fintechs such as Razorpay, active in the UPI scene, charge around 2% of the transaction value as fees from their business clients. Providing value by addressing businesses' unmet needs using the speed prowess of UPI, they stand out from their bank counterparts. What sets them apart from other fintech players like Paytm is their specific emphasis on business banking, with the ultimate goal of building a complete financial ecosystem for businesses in India.

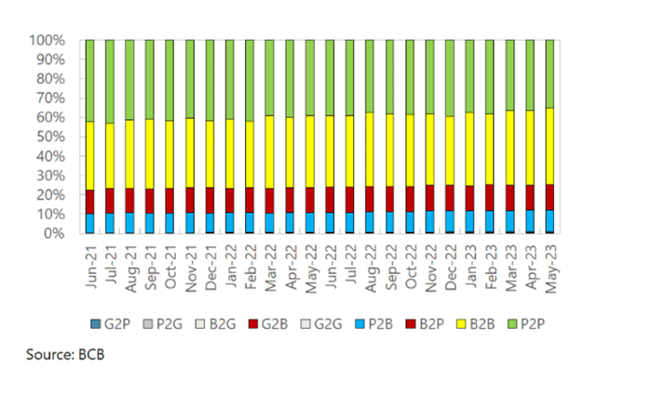

Brazil's PIX payment system is making waves in the B2B sector. Unlike other payment systems that have transaction limits set by the central bank, PIX has no such restrictions, making it popular with businesses. The government's involvement in PIX has also allowed businesses to offer the service at a very competitive rate of 0.33% of the transaction amount.

PIX has a substantial share of B2B payments volume

PIX has a substantial share of B2B payments volume

The genuine revenue driver for banks lies in Business-to-Business (B2B) payments. Immediacy, data-rich transactions, and precise timing are crucial for businesses. This is evident in RTP's exceptional ability to hold payments until the last possible moment, aligning perfectly with businesses' specific needs. Notably, a significant portion of the network's origin is attributed to smaller banks like Cross River Bank, deriving substantial non-interest income by leveraging their capacity to offer APIs to fintechs. This enables them to support various use cases, including B2B loan funding, B2B payouts, and other revenue-generating activities for banks.

Commenting on this, Kasi Annamalai, Head of Instant Payments at Finzly, remarked, “Banks must choose API-driven instant payment solutions that can seamlessly integrate with various platforms, including their own digital banking platforms. Additionally, they should have the ability to send instant payments. Needless to say, revenue, particularly from B2B transactions, hinges on this capability.”

ISO20022 as a value driver for B2B instant payment transactions

Utilizing the ISO20022 data embedded in instant payment transactions, banks can augment these transactions with comprehensive insights and value-added services. This not only ensures heightened cash visibility for businesses utilizing instant payments but also empowers them to seamlessly reconcile purchase orders and invoices. Leveraging the ISO20022 data enables businesses to generate payment requests through e-invoices, respond to e-invoices by initiating payments, and execute transactions at virtual account levels, streamlining the entire reconciliation process.

As the payments landscape becomes increasingly competitive, banks are gearing up and turning to alternative real-time cores designed for instant payment use cases. These solutions are tailor-made to generate revenue in the B2B space.