Corporate treasurers are always looking at improving efficiency, and one of the key asks from many of them is integrated payables as part of their digital banking. By combining payment instructions in a single file irrespective of the payment type, businesses can reduce the overhead on their A/P and internal treasury management systems.

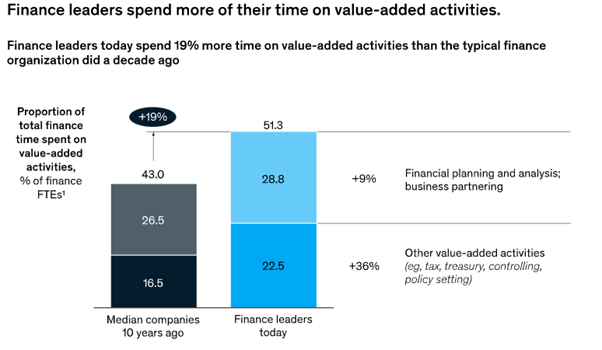

McKinsey reports show that today's finance professionals are able to spend more time on value-added activities – 19% more than what finance organizations did a decade ago. Thanks to timesaving operational efficiencies brought about by the likes of integrated payables.

Source: McKinsey

Why do businesses ask for integrated payables from their banks?

Integrated payables offer advantages to corporate treasuries and help treasurers to:

- Move away from checks into digital payments

- Increase operational efficiency of A/P processing through automation

- Maintain cash flow by making payments just in time

- Enjoy more transparency into payments through reporting and confirmations offered by the bank

- Manage liquidity easily, especially where global operations are involed

- Manage payments for in-house banks

- Manage better vendor relationships through a transparent payment process

- Enjoy cost savings by eliminating checks, by adopting low-cost payment methods

- Reduce payment fraud

Payments as easy as pie

With customer expectations for simplicity pervading every nook and corner, payments are no exception. Treasurers no longer want to expend time to prepare for individual payment rail-specific formats, but would rather worry about “where”, “when”, and “how much”. Of course, they expect transparency in the end-to-end payment process. All said, if banks can extend the “FedEx” experience of payments to treasurers through integrated payables through more automated processes, it can help treasurers improve liquidity, and manage risks while also being able to better forecast their cash position.

For many corporates, an integrated payables solution from banks is the first step towards moving towards improving their cash management.

Payment hubs and integrated payables – the perfect combo

As businesses move into the FedEx experience for payments, they no longer need to worry about the “how” of payments that are being sent as part of integrated payables. Banks that have payment hubs can use intelligent rules and route the payments through the least cost payment rail, depending on the “when” and “where” of the payment as specified in the file, while ensuring on-time delivery. For a payment that has to meet an urgent deadline, the bank can route it through RTP/FedNow/wire/Same-day ACH, while a payment that’s not due until the end of next week might ride the regular ACH rail.

Integrated payables: A must for the digital corporate banking experience

Offering new digital corporate experiences via online portals and digital banking is helping many banks differentiate from the commoditized solutions that otherwise reach corporate customers. Through a single touchpoint in digital banking, banks can allow corporate customers to access many corporate products and services. Banks can increase loyalty amongst their corporate customers while being able to attract new customers through innovative products like integrated payables.

The pandemic has certainly urged the need for better cash flow management by corporate treasuries and integrated payables is an invaluable tool to get started.