Eligibility to participate in the FedNow network: An analysis

The last few weeks have seen much hubbub about nonbank participants wanting to be direct participants of the FedNow network. Members of the Financial Technology Association, which represents fintechs including Block, Marqeta, Stripe and Wise, among others, are keen to bypass sponsor banks and directly access the instant payments service on the FedNow network.

Here are some top questions answered to appreciate the pros and cons of the current situation.

Who is eligible to participate in the FedNow network currently?

At present financial institutions that are eligible to hold accounts at Federal Reserve Banks can directly connect or access the network through a service provider. Banks of all sizes, in turn, can offer the service to the through the communities they serve, ensuring a nationwide scope.

- The eligible participating entities are referred to as “banks” and include entities that are eligible to hold accounts at the Reserve Banks, including FIs, branches of foreign banks, certain international organizations, the U.S. Treasury, and others deemed by the federal statutes, policies and procedures. These participants can either choose to connect directly or connect through a Third-Party Service Provider (TPSP). They also have the freedom to settle in the account of a correspondent.

- Those that are not eligible to directly settle are referred to as “nonbanks”. Examples include payment companies who are not eligible to hold Reserve Bank accounts. These nonbanks can access the service through depository institutions as they do today for ACH or Fedwire.

- The Fed allows nonbanks to act as service providers or agents for participating banks.

|

|

Banks |

Nonbanks(TPSP) |

Other nonbanks |

|

Direct connection with FedNow |

Y |

Y |

N |

|

Settlement facility |

Y |

N |

N |

|

Sponsor bank needed? |

N |

Y |

Y |

Why are nonbank participants allowed to access the payment networks directly in other geographies?

In other geographies where instant payments have been around for a while, nonbank Payment Service Providers can open settlement accounts, become settling participants in payment schemes settled by the central bank, including instant payment schemes. The central banks emphasize that this arrangement helps to increase competition and innovation, expanding the range of electronic payments settled on these payment networks.

In other geographies, what is the typical process for nonbank service providers to directly settle?

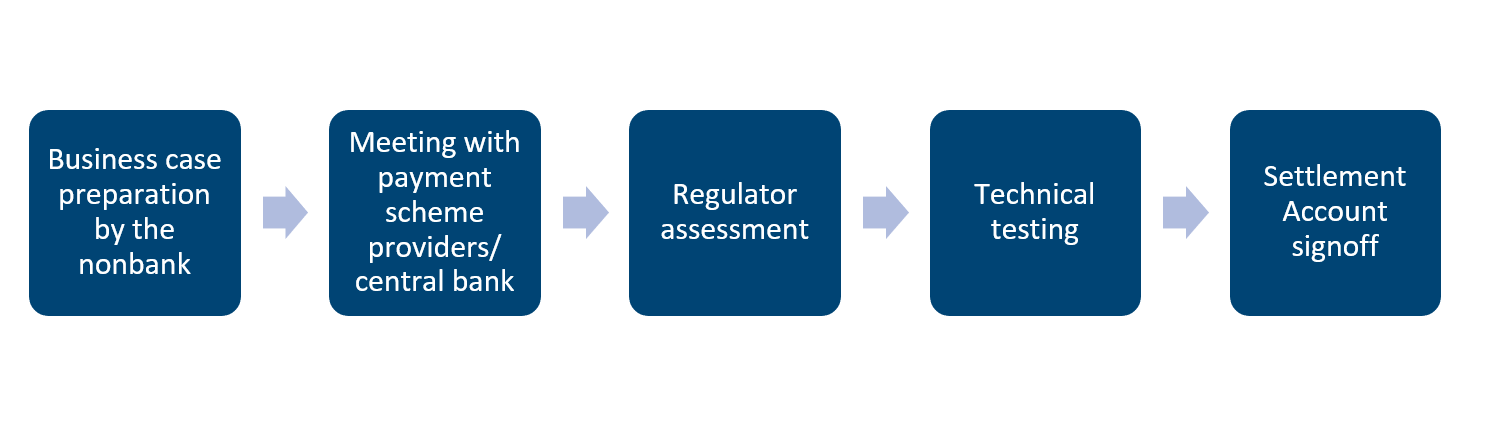

In a nutshell, this is the process that nonbank service providers adopt to become direct settlement participants in other countries.

Where could this potentially head in the US from here?

Supporting ambitions for a more level playing field in payments, the UK amended its Banking Act and regulations around settlement accounts to help nonbanks access instant payments without having to partner with a bank. As a result, fintechs like TransferWise and Modulr have been able to settle into their own settlement accounts held at Bank of England.

Nevertheless, we cannot make an apple-to-apple comparison between the banking landscapes of the US and UK. There is a marked contrast in the number of banks under the tutelage of the instant payment scheme. While the UK only has 40 banks and nonbanks connected to the Faster Payment System, the US FedNow network is available to more than 10,000 institutions. A scale of 250x warrants more preparation by regulatory bodies, FedNow and the central bank to ensure that the risk profile of the financial infrastructures is not increased excessively.

This is an eyeopener for more banks to rise to the occasion and participate in the instant payment network as direct or indirect participants. Any delay in FedNow adoption is bound to open the perimeters of instant payment infrastructure and settlement accounts to nonbanks. Well, they too have a case to reduce the systemic risks from only a handful of banks hosting the indirect nonbank participants!