Here is an article that was published in The Findley Reports Banking Newsletter, June 2021.

Fintechs have taken the financial marketplace by storm, serving as hubs of innovation. However, they need a landing point on incumbent banks to offer their services. Undoubtedly, the technology stacks of legacy cores are no match to host modern fintech products.

More and more community banks are expressing their desire for core-independent innovations. Nevertheless, banks don’t want a total divorce as they still prefer to run innovation in parallel with run tried and tested business conducted on their legacy cores. Today’s banking is beyond mere financial services – banks need to defend themselves by creating value to win and retain customers through innovation.

Acquisitions and partnerships between community banks and fintechs are happening fervently in a race to innovate. However, banks need to find smart and sustainable ways to make this work without disrupting their core.

According to Deloitte’s report on ‘Closing the gap in fintech collaboration’[1], the industry is still ‘lacking that perfect ‘Kumbaya’ moment of fintechs and financial institutions holding hands’, ‘Kumbaya’ referring to an effort towards harmony and unity.

Digital cores can help to spark that ‘Kumbaya’ moment of fintech-bank partnerships. This article attempts to understand how digital cores can enable a symbiotic partnership between community banks and fintechs. As an overture, it is important to understand the layered structure of a bank.

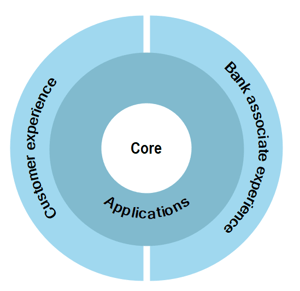

The bank anatomy simplified – the 3-layer structure

- Core:

At the heart of all banking lies the powerhouse of operations, the core, designed to handle a high volume of transactions. While celebrated for its reliability, the core cannot process in real-time and is less open to quick integrations with third party and fintechs- faults traceable to its obstinately obsolete architecture.

Bank anatomy simplified

- Applications:

This is the layer where the products and services of the banks are held in the form of banking applications, supported by different technology stacks from the core. Examples include products such as Lending, Payments, Foreign exchange, Cards. These applications realize the processes which define community banks’ offerings.

- Experience layer:

In the face of skyrocketing customer expectations, community banks are under pressure from neo-banks and challenger banks to enrich the experience for their customers. The nimbleness of disrupters in offering a smooth ride to the digital-savvy customer adds more pressure to traditional banks. Banks have been forced to strategize on omnichannel offerings, user experience and real-time personalized interfaces for their customers.

Straining every nerve

Banks are under increasing pressure to embed themselves into the daily lives of customers. Community banks, too, straining to go beyond traditional financial services, are finding themselves drifting into uncharted waters. Many banks use meaningful fintech partnerships as survival kits, ensuring complementary and meaningful services for their customers. Even to stay abreast with innovative contemporaries and tech-savvy digital banks, community banks need open architecture with APIs that can easily and quickly integrate with fintechs of their choice.

Digital core – the cradle of innovation

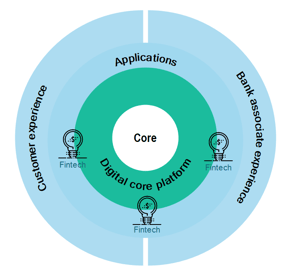

Digital cores are designed to be real-time, API-based and scalable, supported by cloud architecture that accelerates integration with third-party fintech apps. Today’s community banks are obliged to not just partner, but also to integrate and build their own products. The scalable, cloud-hosted, digital platform that enables banks to plug and play and leverage the power of APIs is called the ‘digital core’.

Digital cores dovetail without disrupting the existing cores

Digital core platforms run either as standalone cores or parallel to the banks’ existing core. When integrated to the existing core, they form a stratum for innovation, where fintechs can easily integrate their products without having to go through complex and sometimes impossible integrations to the existing cores.

The APIs on the digital core platform open up easy integrations for fintech applications of choice, thus allowing community banks to compete and meet the evolving needs of the market and customers. To achieve the required agility, banks need platforms that can integrate to the central core, while supporting the application and experience layers.

The digital core platform makes fintech partnerships easier

The stubborn and volume-based pricing structure of existing cores hampers the implementation of new products. Many community banks are seriously considering taking advantage of the fast, secure, simple and affordable nature of digital core platforms, which open up horizons for collaborating with fintechs and leads to better synergy in the financial transformation effort.

[1] us-fsi-dcfs-fintech-collaboration.pdf (deloitte.com) Closing the gap in fintech collaboration