Credit unions must embrace instant payments or be left behind

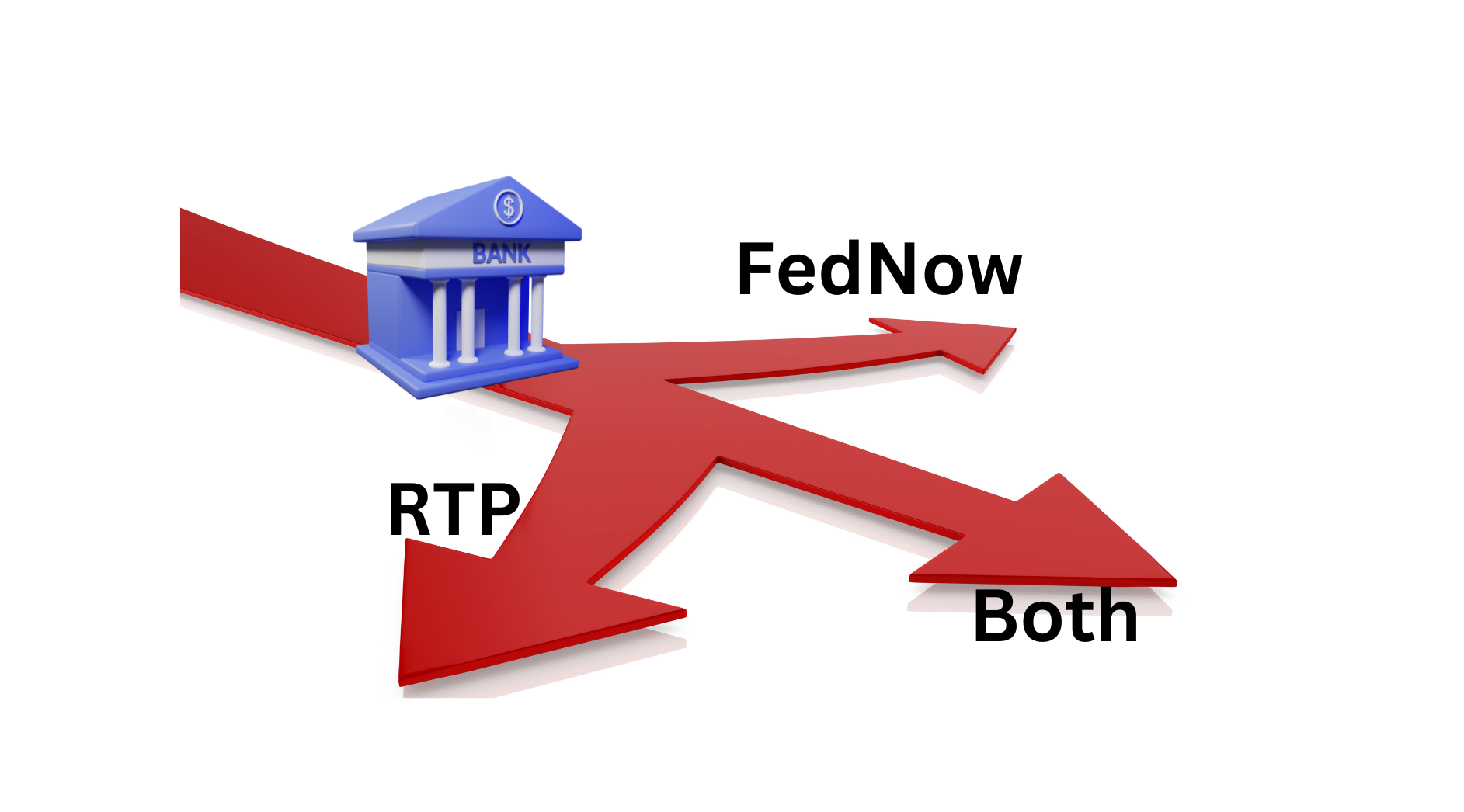

Despite being commonly perceived to be pitted against each other, RTP® and FedNow® are actually working together to increase the accessibility and usage of instant payments. In a recent Faster Payments Council webinar, representatives from The Clearing House (TCH) and the FedNow Service, alongside Finzly and moderator Gene Neyer, deliberated on the challenges encountered by financial institutions when integrating with instant payment rails.

One audience member brought up an intriguing question: With both rails being so similar, why keep them both? Despite their comparable transmission speeds, it's the diverse value-added services they provide that often determine the specific applications they support. Commenting on how their paths diverge when it comes to value-added services, Bernadette Ksepka, VP - FedNow Service remarked, "Over time, our overlay services may differ," depending on the unique segments and use cases each network serves.

Despite launching at different times, both RTP and FedNow are confident in their ability to coexist and thrive, much like their existing ACH and wire offerings. They anticipate that their differences will fuel innovation in how the rails are utilized.

According to 50% of financial institution survey respondents who reported being on both networks during the webinar, adopting both networks instead of choosing one over the other is becoming increasingly common among financial institutions.

The US financial system relies heavily on smooth and reliable electronic transfers. Having two independent operators (TCH and Fed) for both ACH and wire transfers provides a crucial fail-safe mechanism. It provides redundancy, drives innovation, offers choice, and maintains a healthy balance between public and private interests. Instant payments are going the way of ACH and wires, with multiple players in the mix.

Although achieving interoperability among these systems may seem far-fetched, Karuna Kathir, Head of Sales at Finzly, suggests that financial institutions should prioritize providing instant payments rather than simply selling the payment rails to customers. He adds, "Finzly simplifies the adoption of these multiple networks for both banks and their customers, offering cost-effective licensing and a common implementation for instant payments on both networks to banks. For end users, Finzly provides a simple experience that shields the rail mechanics, offering an 'instant payment experience' rather than a rails-specific one, while also reducing payment failures due to better network coverage."

In the US, having multiple networks for wires, ACH, and checks is standard practice. The gateway model emerges as the solution to this complexity. This trend is witnessing a resurgence in payment hubs, particularly those with genuine central processing capabilities.

Jim Colassano, SVP at The Clearing House suggested selecting the network with the most economic value. He highlighted the potential for both networks as many banks are interested in utilizing TCH's established maturity and FedNow's promised long-term evolution. He noted that over 200 institutions are connected to both networks, underscoring the current focus of financial institutions on TCH while also keeping an eye on FedNow as it expands. He emphasized Karuna's observation, highlighting that 90% of financial institutions in the RTP comprise credit unions or community banks. He stressed that their participation in these networks stems from their commitment to adding value to customers, rather than their size.

Many banks are interested in utilizing TCH's established maturity and FedNow's promised long-term evolution.

During the webinar survey, 81% of respondents indicated they do not currently utilize instant payment networks for sending payments. Both the Fed and TCH emphasized the necessity of developing use cases for sending payments as crucial to the success of these networks. While the Fed and TCH provide the infrastructure for instant money transfers, Bernadette emphasized the need for banks to create their own instant payment "send" experiences to facilitate customer transactions seamlessly.

Many financial institutions often confuse FedNow and RTP with PayPal and Zelle transactions. However, Bernadette clarified that these are closed networks capable of settling on any rail, including the instant and ACH rails. This underscores the importance of distinguishing between instant payment experiences and capabilities, emphasizing the need for banks to consider developing "send" experiences within their internal applications that leverage the A2A transaction power of the rails.

Karuna mentioned that financial institutions aiming to make the most of instant payments often opt for Finzly's send experience, seamlessly integrating it into their digital banking solutions. This preference arises because many digital banking vendors are still not equipped to offer such capabilities. He emphasized that Finzly's APIs empower banks to effortlessly incorporate the send experience into their internal systems and also power embedded banking use cases for fintechs and platforms.

Leveraging the infrastructure, banking experience, and APIs from a unified platform ensures that banks can fully harness the potential of instant payments in a seamless, timely and future-proof manner.

Despite concerns about fraud hindering the adoption of send capabilities by financial institutions, Gene emphasized, "Fraud rates are among the lowest compared to other rails." He stressed the importance of implementing two-factor authentication and reiterated that banks have the responsibility to address fraud alongside their instant payment processing.

The lack of real-time processing capabilities of their legacy payment systems and core was cited by close to 40% of the participants as the reason for not sending.

40% of the survey respondents cited the lack of real-time processing capabilities of their legacy payment systems and core for lacking the ability to SEND instant payments.

However, banks are seeking solutions beyond their traditional legacy systems for instant payments, driven by the critical need for real-time processing. "You don't need a payment system" what you need is a payment core that completely hollows out payment processing functionality from the core and places it on platforms like Finzly for real-time payment processing," said Karuna Kathir. Vendors such as Finzly offer banks an instant payment rail that supports RTP and FedNow, ensuring coverage and ubiquity, with a shared transaction tier for the two networks, making it easy and cost-effective.

The push to adopt instant payments is driven by a simple fact: even though customers might not be asking for real-time capabilities outright, they definitely expect them. As Jim remarked, "Customers aren't asking, but they are expecting. Get in the game." Bernadette echoed this sentiment, urging financial institutions, "Don't sit on the sidelines."

As Karuna Kathir aptly stated, "Banks are no more early adopters. These networks are established." The instant payments era is well underway, and financial institutions that embrace this transformation with innovation, customer-centricity, and a strategic approach will undoubtedly emerge as leaders in this new era of real-time financial services.