This 3-step approach to modernization enables banks to play a strategic and cooperative role in the co-creation of value to the end customers.

Post-pandemic trends indicate that digital payment options, convenience and speed of payments are here to stay, contrary to the conjecture that they were a temporal fad spurred by the pandemic.

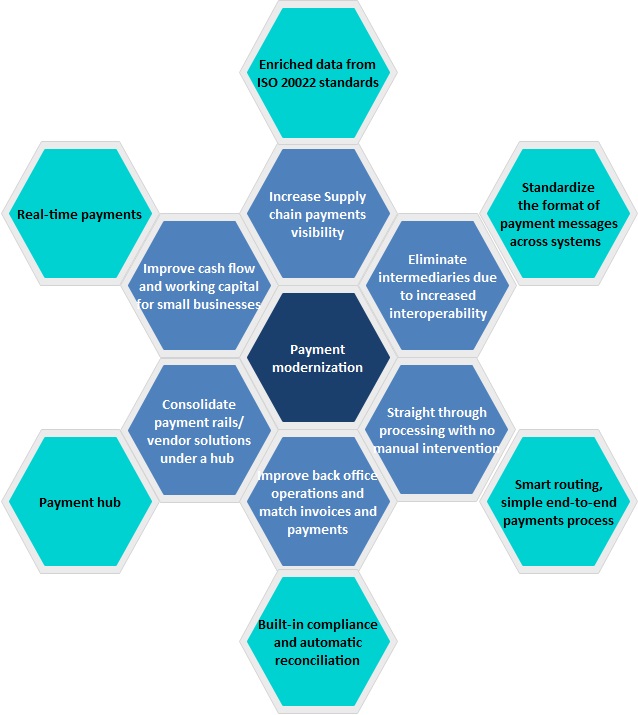

Payment infrastructure modernization projects have been put on steroids at many banks as a groundwork to meet the unprecedented demand for agility, speed and convenience in payments. Banks are moving their payments to cloud-native platforms that help them meet the demands created by digital disruption. Additionally, these initiatives also help them court fintech partnerships, opening up non-interest income.

Redefine the traditional value chain of payments

While the changing role of banks in the payment ecosystem is a bitter pill to swallow for many banks, many of the liberal traditional banks are already accepting new business models, reinventing their participation in the traditional value chain of payments. Banks promote models like Banking as a Service through platforms outside their legacy core, helping them experiment these agile models with less risk and more sustainable success.

Why are banks struggling to modernize their payments infrastructure?

Due to the rigidity of existing legacy cores, banks have been confining payment transformation to shallow, patching-up initiatives on their existing mainframe systems. A full blown rip of the core for incumbent banks is a traumatic, painstaking, protracted, multi-million-dollar project. With the long waiting times with existing core providers, incumbent banks face the risk of being overtaken by neobanks and other fintechs.

This leaves banks to come up with imprudent and sporadic renovation, doing no good to the end customer consuming these services nor to the bank, leaving it with an even more convoluted architecture.

What are the 3 steps that banks take towards successful payment transformation?

We see that banks that culminate with a successful payments transformation embark on a 3-step journey.

- Modernize outside the core:

Payment solutions offered by legacy core providers are often overwhelming and tie incumbent banks down to the limitations of antiquated processing. These do not support the payments modernization roadmap that is apropos for banks who want to innovate with freedom. A decoupled payments engine from the core helps by offering greater agility to banks.

The flexibility of a scalable, cloud-native technology keeps costs low, while supporting innovation at scale. A core-agnostic digital payments core does the job without ripping the core.

A modernization exercise outside the core brings a panoramic view of the different attributes of payments that need to be considered in order to future-proof the transformation.

2. Adopt a modular transformation:

Often banks are left at crossroads with so many flavors of payment solutions that they are confounded on making the right choice that suits their bank’s vision. A successful payment transformation program will benefit from flexibility to modularly go on board, controlling the risk better, and reinforcing the ROI for the endeavor. Many banks start with ACH, move to wires and then to real-time payments giving them the confidence through an iterative and risk-controlled approach.

3. Offer Payment as a Service

More fintechs who want to embed banking services in their products and services are turning to traditional banks who offer these services. Payments is a much sought after service. Banks that have the right payment core on a supple platform are able to easily offer payments as a service to fintechs and other financial and non-financial service providers who are looking to embed payments. Some of the top services that fintechs go after include access to:

- ACH

- Wires

- Swift

- Real-time payments

- Payment experience services

Payment modernization that moves towards the reuse of the payment processing core by fintech partners allows banks to offer Payments as a Service by decoupling the payments engine outside the core platforms. This 3-step approach to modernization enables banks to play a strategic and cooperative role in the co-creation of value to the end customers. This way banks enjoy the benefits of leveraging fintech partnerships, getting closer to customers and keeping their payment tech stack future-proof.

Interested to know how Finzly is helping banks on payment modernization?