In October, the CFPB proposed rule 1033 to accelerate open banking adoption through Personal Financial Data Rights. This development signals a seismic shift in the landscape of financial services, with a focus on fostering more competition and collaboration between traditional banks and innovative fintech companies. The driving force behind this transformation is the increasing emphasis on sharing financial data through standardized methods, particularly via open banking Application Programming Interfaces (APIs).

Well, to make this collaboration work, there must be a common language, and that's where open banking standards come into play to benefit all ecosystem players. Open banking is not a solitary endeavor but a collective industry initiative. The benefits are manifold, encompassing greater empowerment for consumers over their financial data, the lucrative revenue potential for banks through APIs, and the fostering of enhanced competition and fairness in the provision of financial services.

Let's break it down with some FAQs:

How do banks currently share data?

Many banks currently employ a method known as "screen scraping" to access and collect data. This involves a third party requesting customer credentials to extract information, which is subsequently provided to fintech platforms, such as payment services and PFM apps.

Who utilizes the data obtained through screen scraping, and what are its drawbacks?

Fintechs, neobanks, utility providers, and non-bank lenders use this data for various purposes. But here's the catch: sharing bank account credentials of customers through screen scraping can pose significant security risks.

What is the global perspective on move towards open banking away from screen scraping?

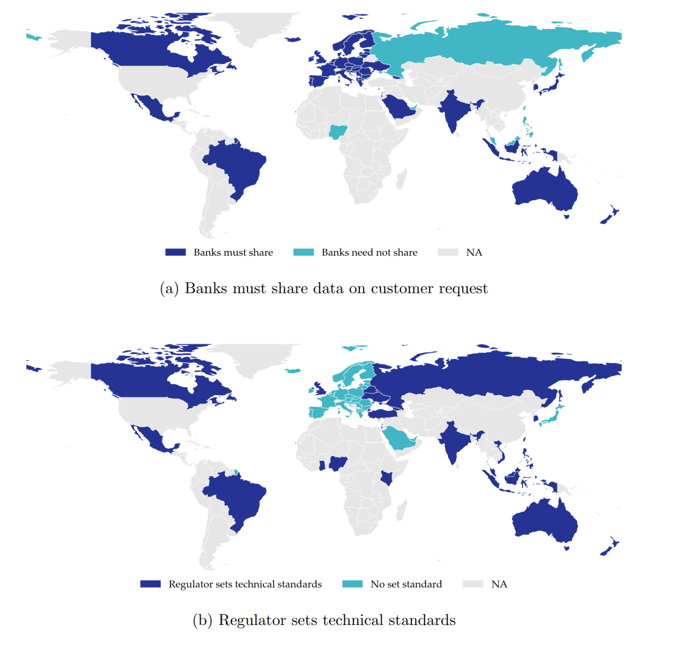

While the UK and the European Union have already embarked on the open banking journey, Canada's government is in the process of establishing an open banking framework to phase out screen scraping. Australia, much like the United States, is actively gauging market sentiment to transition away from screen scraping towards open banking alternatives.

Source: fdic.gov

What should banks do to prepare for the open banking era?

Banks need to embrace more open and API-driven infrastructure and solutions for their operations. For example, the adoption of instant payments through outdated systems lacking open APIs hampers innovation and readiness for data sharing in the emerging open banking landscape.

How can banks make the most of this rule through monetization as they move from screen scraping to open APIs?

Take Natwest Bank in the UK, for instance. They've set up the "Bank of APIs" to share their APIs with Third-Party Providers (TPPs). They have successfully monetized their APIs in payments, and a broad spectrum of services, including mortgages, lending, digital ID, real-time foreign exchange, and risk management capabilities. In preparation, banks are exploring API-first solutions like Finzly Connect to seamlessly connect with the ecosystem and share data with downstream partners.

In conclusion, the impending open banking revolution is set to redefine the way financial institutions and fintech companies collaborate, setting the stage for a dynamic and customer-centric future in the world of finance. By embracing open APIs, institutions can unlock a world of possibilities, ushering in an era of innovation, competition, and enhanced services for consumers.